Mutual funds have become one of the most popular investment options for Indians, thanks to their potential for high returns, professional management, and diversification benefits. However, many investors, especially beginners, often fall into common traps that can hurt their returns and derail their financial goals.

In this blog post, we’ll dive deep into the 5 Most Common Mutual Fund Mistakes Indian Investors Make And provide actionable tips on how to avoid them. Whether you’re a seasoned investor or just starting out, this guide will help you make smarter decisions and maximize your returns.

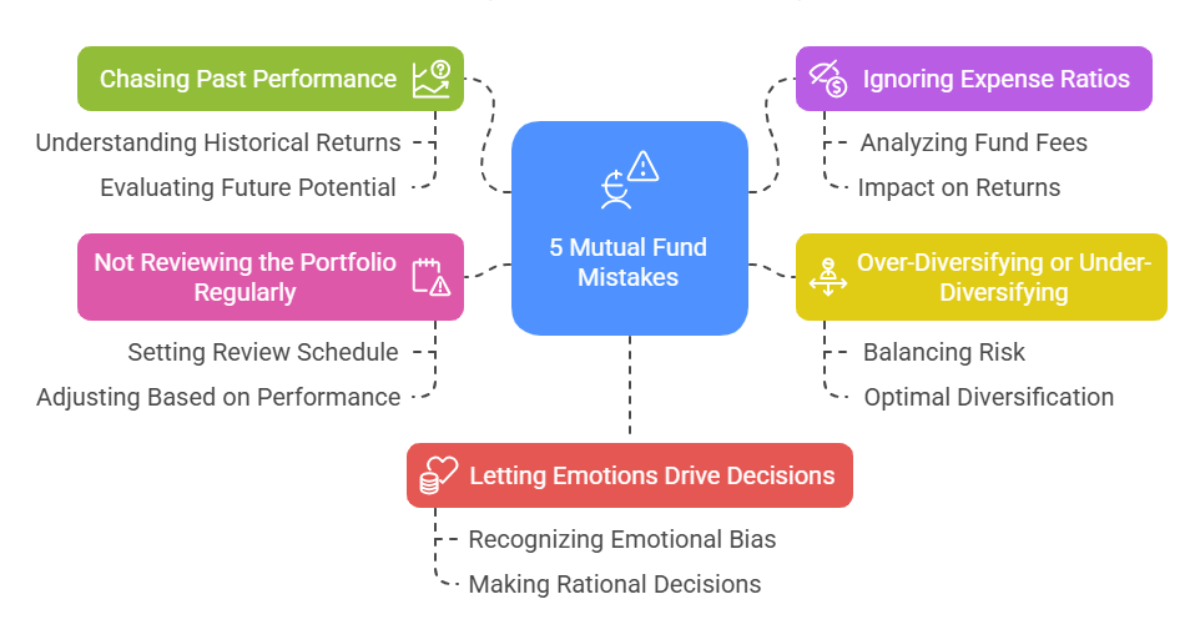

5 Mutual Fund Mistakes Every Indian Investor Makes (And how to avoid them)

Mistake 1: Chasing Past Performance

The problem:

One of the biggest mistakes investors make is selecting mutual funds based soly on their past performance. It’s tempting to look at a fund that delivered 30% returns last year and assume it will do the same this year. However, past performance is not a reliable indicator of future results.

Why it happy:

- Investors often relay on “Top-Peerming Fund” lists published by Financial Websites or Advisors.

- The fear of missing out (fomo) Drives them to Invest in Funds that are currently in the limelight.

The reality:

- Funds that perform exceptionally well in one year often underperform in the next due to market cycles, changes in fund management, or sector-specific risk.

- Example: Many Sectorral Funds (EG, Technology or Pharma Funds) May Deliver Stellar Returns in a Bull Market but Struggle Dining a downturn.

How to avoid it:

- The simple strategy is to adopt index funds. No matter how experience the fund manager is, underperformance is part and parcel of an active fund. Hence, to avoid the risk of fund manners, adopting the simple and low-cost index funds is better.

- Avoid Chasing “Hot” Funds and Instead Invest in Diversified Equity or Hybrid Funds that Align With Your Risk Tolerance and Financial Goals.

Mistake 2: Ignoring Expensese Ratios

The problem:

Many investors overlook the impact of experience ratios on their mutual funds. The expense ratio is the annual fee charged by the fund for managing your money, and it can significantly Eat into your returns over time.

Why it happy:

- Investors often focus only on returns and ignore the costs associated with investment.

- They may not fully undertand how even a small difference in expensese ratios can compound over the long term.

The reality:

- A Fund with a 2% Expense ratio will cost you? 20,000 Annually for every? 10 Lakh Invested, while a Fund with a 0.5% Expensese Ratio will cost only? 5,000.

- Over 20 Years, this difference can Amount to Lakhs of Rupees due to the power of compounding.

How to avoid it:

- Always Compare Expense Ratios Before Investing in a Fund.

- Opt for direct plans INTEAD of Regular Plans, as they have lower experience ratios.

- Consider low-cost index funds or etfs, which typically have experience ratios below 0.5%.

Mistake 3: Over-DIVERSISIS OR Under-DIVERSISF

The problem:

Diversification is key to Reducing Risk in your Portfolio, but many investors eiters overdo it or don’t do end.

- Over-diversification: HOLDING Too Many Mutual Funds Can Dilute Your Returns and Make It Dificult to Track Your Portfolio.

- Under-diversification: Putting all your money into one or two funds can expert you to unnecessary risk.

Why it happy:

- Investors often Think that adding more funds will automatically Reduce Risk.

- Others may focus too much on a single sector or theme, hoping to maximize returns.

The reality:

- Over-diversification can lead to overlapping holdings, where multiple funds invest in the same stocks.

- Under-diversification can result in significant losses if the chown sector or fund underperforms.

How to avoid it:

- AIM for a Balanced Portfolio With 4-6 Mutual Funds Across Different Categories (EG, Large-Cap, Mid-Cap, Debt Funds).

- Avoid overlapping funds by checking their portfolio holdings.

- Rebalance your portfolio periodically to maintain the right asset allocation.

Mistake 4: Not reviewing the portfolio regularly

The problem:

Many investors adopt a “set and forget” approach to mutual funds, assuming that their investments will grow on autopilot. However, Failing to review your portfolio regularly can lead to suboptimal returns.

Why it happy:

- Investors May Lack the Time or Knowledge to Monitor their Investments.

- They may not realize that Market Conditions, Fund Performance, or their Own Financial Goals Can Change Over Time.

The reality:

- A fund that was performing well 5 years ago May no longer be suitable for your portfolio.

- Changes in Fund Management or Strategy Can Impact Future Returns.

How to avoid it:

- Conduct a Portfolio review at least once a year,

- Check If your funds are still aligned with your finance goals and risk tolerance.

- Exit underperforming funds or that that no longer fit your strategy.

Mistake 5: Letting Emotions Drive Decisions

The problem:

Investing in Mutual Funds Requires Discipline and a long-term percent. However, many investors let emotions like fear and green dictate their decisions.

- Fear: Selling off investments during market crashes or downturns.

- Greed: Chasing high returns or investment in risky funds without proper research.

Why it happy:

- Market Volativity Can Trigger Panic, Especially for Inexperienced Investors.

- The desire for quick profits can lead to impulsive decisions.

The reality:

- Selling during a market crash locks in losses and preventes you from benefiting from the Eventual Recovery.

- Chasing High Returns often Leads to Investing in Unsupitable or High-Risk Funds.

How to avoid it:

- Stick to your Financial plan And avoid making impulsive decisions based on market trends.

- Remember that Mutual Funds are a long-term investment, and short-term fluctuations are normal.

- Focus on your goals and stay disciplined, even during market valatiity.

One of the best ways to maximize your mutual funds is to start investment early and contribute regularly. Thanks to the power of compounding, even small investments can grow into a significant corpus over time.

Conclusion:

Investing in Mutual Funds Can Be a Rewarding Experience if you Avoid these Common Mistakes. By focusing on long-term goals, keeping costs low, and staying disciplined, you can build a strong portfolio that helps you achieve financial freedom.

Remember, the key to successful investment is not timing the market but Time in the marketSo, take the first step today, Avoid these Pitfalls, and Watch Your Wealth Grow!